The 2023 Legislative session is in full swing and Paper Prisons has produced research that has been cited in several ongoing campaigns. Below we highlight key findings from our reports on the “second chance gap” in expungement remedies offered under the laws of Missouri, Oregon, Illinois, Texas, Minnesota, and New York:

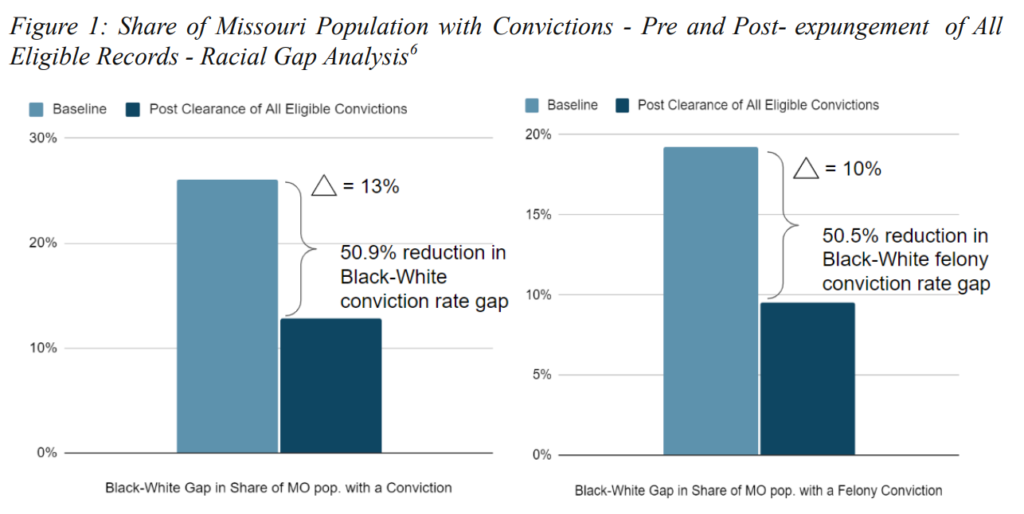

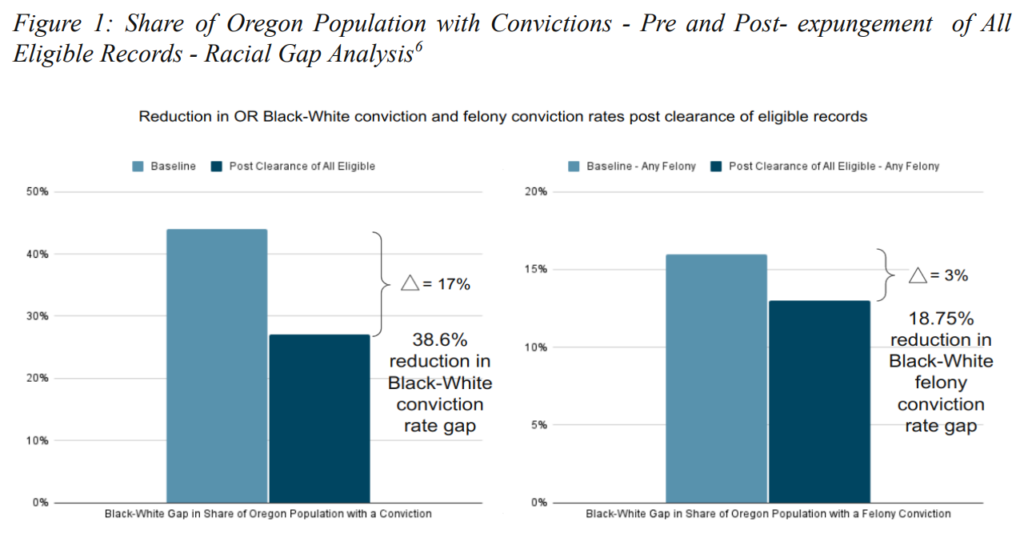

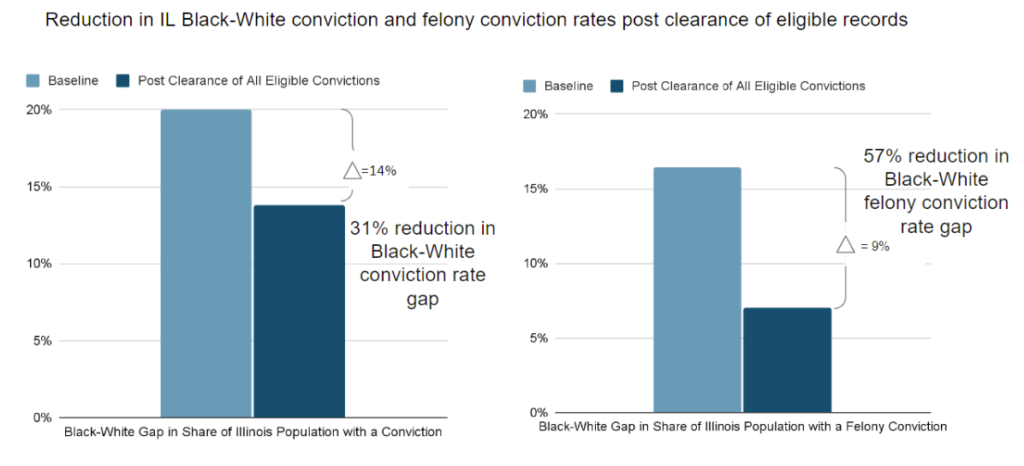

- Clean Slate automation has the potential to dramatically reduce the White-Black racial gap in populations with a conviction and felony conviction, as evidenced by our reports on expungement in Illinois, Missouri, and Oregon:

- In Missouri, SB 347 seeks to automate expungement for eligible nonviolent offenses, infractions, misdemeanors, or felonies. Our Missouri report estimates that automating expungement would reduce the White-Black racial gap among those with conviction records by 50.9% and among those with felony conviction records by 50.5%.

- In Oregon, SB 697 and SB 698 seek to streamline and automate expungement for eligible convictions, arrests, citations, charges, and guilty judgments (exception for insanity). Our Oregon report estimates that streamlining and automating expungement would reduce the White-Black racial gap among those with conviction records by 39% and among those with felony conviction records by 19%.

- In Illinois, SB 1555 seeks to automate expungement for eligible law enforcement records, criminal records, and court records. Our Illinois report estimates that automating expungement would reduce the White-Black racial gap among those with conviction records by 31% and among those with felony conviction records by 57%.

- Clean Slate Automation would significantly increase the uptake of records relief and also has the potential to significantly reduce the earnings lost due to records, which is estimated to total close to 22B in the 6 states covered by our reports. To take two states for example:

- In Texas, SB 499|HB 1737 seek to automate nondisclosure of eligible misdemeanor record information. Our Texas report estimates only 5% uptake of petition-based relief absent nondisclosure automation. Based on this current rate, our report found that it would take 255 years to clear this conviction sealing backlog. Our report also estimates a $3.5 Billion aggregate annual earnings loss associated with sealable records, which can be mitigated with automation.

- In Minnesota, HF 2023 seeks to automate expungement for offenses eligible for relief. Our Minnesota report estimates only 5% uptake of petition-based relief absent expungement automation. Based on this current rate, our report found that it would take 173 years to clear this expungement backlog. Our report also estimates a $2.4 Billion aggregate annual earnings loss associated with clearable convictions, which can be mitigated with automation.

A summary of the aggregate findings from our reports is provided below

Table 1: Estimated Size, Uptake and Lost Earnings Associated with the Second Chance Records Relief Gap in 6 States

| State | Est. Population Eligible for Relief* | Current Uptake Rate of Relief* | Aggregate Earnings Impact* |

| Texas | 677,000 | 5.0% | $3.5 Billion |

| Minnesota | 470,000 | 5.0% | $2.4 Billion |

| Missouri | 518,000 | <1% | $2.6 Billion |

| Oregon | 295,000 | 5.5% | $1.6 Billion |

| Illinois | 921,000 | 10% | $4.7 Billion |

| New York | 1,400,000 | <1% | $7.1 Billion |

| Total | 4,281,000 | – | $21.9 Billion |

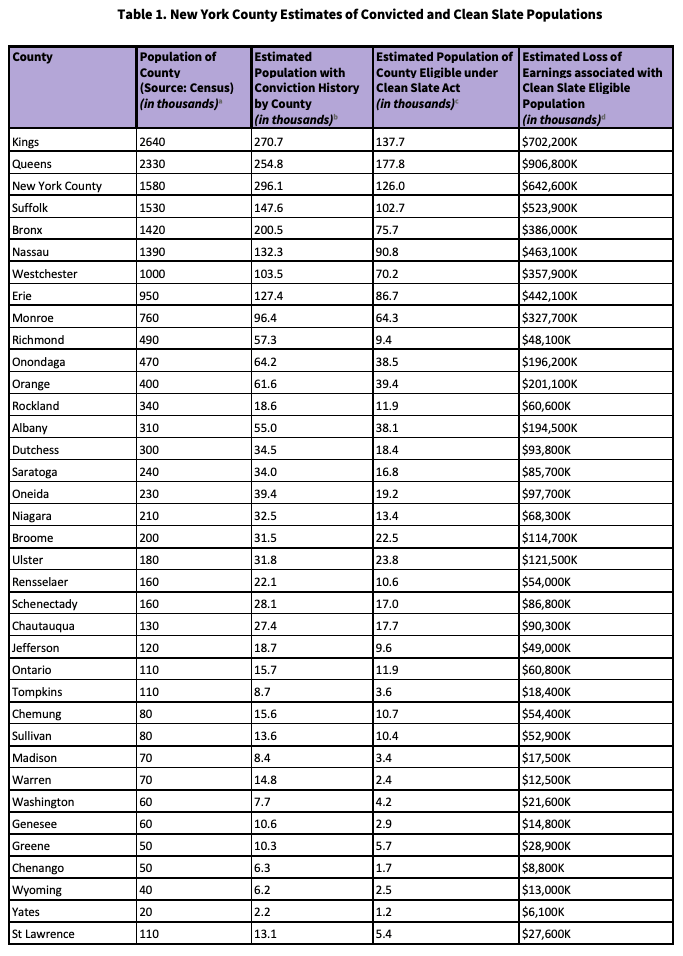

- Clean Slate Automation would have a pronounced impact at the county level, as evidenced by our New York, Illnois and related reports.

- In New York, S 211|A1029 (Clean Slate Act) seek to automate sealing of eligible conviction records. Our New York report estimates less than 1% uptake of petition-based relief absent nondisclosure automation. Based on this current rate, our report found that it would take over 1000 years to clear this conviction sealing backlog. Our report also estimates a $7.1 Billion aggregate annual earnings loss associated with sealable records, which can be mitigated with automation.

Our report further pinpoints the population eligible for relief under the Clean Slate Act and earnings loss associated with sealable records in 37 New York counties. In Queens County alone, 177,800 New Yorkers are eligible for Clean Slate relief, with an estimated $906.8 Million in lost earnings. While in Bronx County, 75,700 New Yorkers are eligible for Clean Slate relief, with an estimated $386 Million in lost earnings.

Similar county-level analyses, leveraging data made available from the State of Illinois, are also detailed in our Illinois report. By estimating these vital metrics in our reports and quantifying the costs of remaining “paper prisons” —with expungeable criminal records—we help to inform the legal and policy debate about criminal records.

This initiative began with the seminal paper America’s Paper Prisons: The Second Chance Gap, published by Paper Prison’s Founder, Professor Colleen Chien, in the Michigan Law Review in 2020. In this paper, Chien introduces the foundational concepts of “the second chance gap”—the gap between eligibility for and delivery of relief from the criminal justice system through, e.g. record expungement or sealing relief laws —and of “Paper Prisons”—deficiencies in the administration of the law that perpetuate conviction barriers, disenfranchisement, and socio-economic burdens beyond what the law requires. A second paper in the Arizona Law Review (2022), with criminologist Robert Apel and others, quantifies the cost of the second chance gap, estimating the lost earnings associated with a conviction record and also a lost driver’s license.

Leveraging “Clean Slate” initiatives to automatically clear or seal eligible criminal records would help reduce the size of America’s “paper prisons” and the “second chance gap” in records clearance. However, debt-related barriers and dirty data can contribute to incomplete automation, leading to “second second chance gaps.”

While researchers on the Paper Prisons team sweat the details on the empirical data on a daily basis, we are gratified to see these details elevated in testimony, legislative discussion, and even on billboards like the one shown above, in NY. Closing the second chance gap, our research suggests, can lead to unblocked opportunities, greater racial equity, and the recovered lost earnings, supporting economic mobility and growth.